By Tom Konrad, Ph.D., CFA

Month-to-month Efficiency

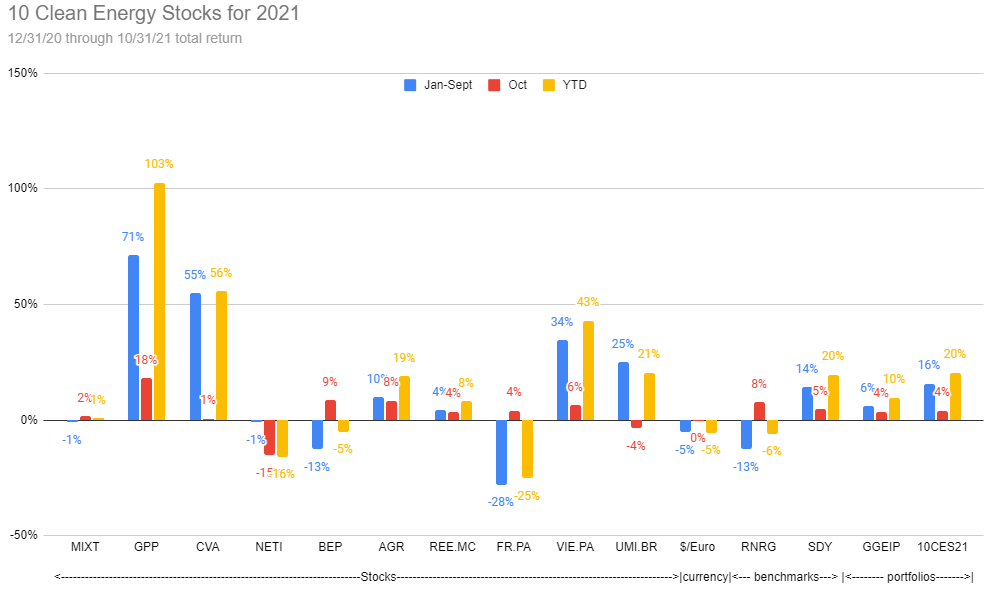

Returns for the Ten Clear Vitality Shares for 2024 mannequin portfolio are proven beneath. It was a great month for clear vitality shares in addition to the broader inventory market, with the portfolio up 4% for a 20% whole return by way of the top of October. Its clear vitality benchmark (RNRG) was up extra (8%) however continues to be down 6% for the yr. Its broad market benchmark (SDY) rose 5% and has caught up with the mannequin portfolio at a 20% return yr thus far.

Earnings

Third quarter earnings season has began. Under are some notes I’ve shared with my Patreon supporters over the previous couple weeks:

MiX Telematics Earnings

MiX Telematics (MIXT) was down on earnings in the present day. I’d name it a case of first rate earnings… the corporate continues to develop income and subscriptions quarter over quarter and yr over yr, however they’re nonetheless a good distance from 2019 ranges.

Oil and fuel clients nonetheless account for a lot of the shortfall, with a lot of the buyer wins highlighted within the earnings name being transit, principally bus fleets. They did say that one large oil and fuel buyer is beginning to deliver a few of its autos again into service.

General, the quarterly efficiency was first rate, however traders have been in all probability hoping for extra of a bounce given the subscribers misplaced in 2020. If something, the long run outlook is bettering, so the latest declines make MiX one of many few shares through which I see worth within the present market.

Inexperienced Plains Companions Earnings

The massive information in Inexperienced Plains Companions’ (GPP) third quarter earnings wasn’t information in any respect. The distribution enhance for $0.435 quarterly which had been introduced in mid-October, and the corporate had advised us to count on the rise in August after I wrote: “I count on the board of administrators to lift the dividend to between $0.40 and $0.45 subsequent quarter.”

The inventory jumped anyway, and now trades round $15. Given its present 11.2% yield, I feel a modest ($1 to $2) additional enhance over the approaching months is probably going.

Enviva Earnings

Word: Enviva isn’t within the present 10 Clear Vitality Shares checklist, however made an look in 2019 and I assumed the information was notable sufficient to make it price writing about.

I had two main take-aways from wooden pellet MLP Enviva’s (EVA) third quarter earnings.

First, the beforehand introduced simplification transaction the place the partnership has purchased out and absorbed its basic associate and is changing to a company construction ought to be nice for the inventory value.

The corporate is guiding for $3.62 of whole dividend funds in 2022. After the shift to a company construction, EVA ought to begin buying and selling with a yield extra in step with its Yieldco friends, round 3 to five p.c. So we are able to count on a share value a yr from now to be within the $72 to $120 vary. With the present share value at $68, I’m pretty bullish.

The opposite take-away is that the corporate is transferring into new markets with the announcement of a long run wooden pellet provide contract to a European producer of aviation biofuel. That is essential as a result of its largest present market, which is promoting to energy producers who burn the pellets in transformed coal energy vegetation has long run limitations.

First, utilizing wooden pellets to generate electrical energy isn’t the very best use for a a renewable gasoline supply which is simple to move and retailer. These are two benefits notably missing within the main renewable vitality sources, electrical energy from photo voltaic and wind. Given the dimensions and weight of batteries wanted, it is rather troublesome to impress lengthy distance aviation. As we transition the world away from fossil fuels, we have to discover renewable vitality sources for each software. Sustainable aviation gasoline is one the place photo voltaic and wind will discover it troublesome to compete, so it is a good long run marketplace for Enviva’s biomass.

Different functions which might be troublesome to serve with electrical energy from photo voltaic and wind are industrial processes similar to metal and cement manufacturing, and the ten to twenty p.c of electrical energy which must be served by long run seasonal storage to satisfy demand that can’t be simply served with wind and photo voltaic. Enviva can also be exploring contracts with industrial clients seeking to decarbonize.

This new contract demonstrates that Enviva has scalable prospects for collaborating the sustainable vitality financial system for the long run, even when its present function as a bridge gasoline to utilize the prevailing infrastructure in transformed coal vegetation involves an finish.

DISCLOSURE: Lengthy all shares within the 10 Clear Vitality Shares for 2021 portfolio and EVA.

DISCLAIMER: Previous efficiency isn’t a assure or a dependable indicator of future outcomes. This text accommodates the present opinions of the writer and such opinions are topic to alter with out discover. This text has been distributed for informational functions solely. Forecasts, estimates, and sure info contained herein shouldn’t be thought-about as funding recommendation or a advice of any explicit safety, technique or funding product. Info contained herein has been obtained from sources believed to be dependable, however not assured.

0 Comments