Tom Konrad, Ph.D., CFA

Hello all Readers, welcome back, at www.tipstoppk.blogspot.com, please like comments and share...

I don’t spend a lot time studying funding firm ESG studies, however a good friend requested me to check out a replica of the TIAA’s 2021 Local weather Report. I used to be deeply unimpressed. Right here are some things within the report that triggered my greenwashing radar:

- TIAA needs to work with corporations to enhance their habits. They name this firm engagement. “[W]e don’t anticipate [asset sales] to account for almost all of our emissions discount — we’re primarily centered on firm engagements” web page 9.

- A lot of TIAA’s emphasis is on lowering emissions from their very own operations, moderately than the businesses they spend money on. For an funding firm, the greenhouse affect of its workplaces and computer systems are tiny in comparison with the impacts of the businesses that it invests in.

- Whereas TIAA has set greenhouse fuel discount targets for the belongings it owns straight, it additionally manages over 4 occasions as a lot cash for different buyers. The report utterly ignores the greenhouse fuel impacts of those investments.

- The place TIAA does have targets, they’re long run, for 2040 and 2050. We have to act now, not in a decade or two.

Given the urgency of the local weather disaster– “Code purple for humanity” because the UN Secretary Common places it– incremental change falls so in need of the necessity that it’s tough to think about it inexperienced.

Why Firm Engagement Doesn’t Lower It

At finest, working with corporations to enhance their habits will produce incremental change. Do we actually see an oil firm utterly ceasing new improvement of fossil fuels, and phasing down its present operations over the subsequent 20 years due to shareholder engagement? The concept appears laughable, however that’s precisely what an oil firm must do if it plans to be a part of the answer, not only a smaller a part of the issue. Even essentially the most formidable oil majors, like BP (NYSE:BP) are simply hoping to scale back the emissions from their very own operations to zero by 2050. If they’re nonetheless producing oil after 2050, they’re a part of the issue.

Participating with corporations to attempt to get them to cut back carbon emissions is best than nothing, however stronger measures are wanted. The potential good points from shareholder engagement are high quality if an organization solely must make small modifications to cut back its greenhouse fuel emissions, however stronger measures are wanted when an organization’s core enterprise causes local weather change. If an funding administration firm needs to assist remedy the issue of local weather change, the one actual answer is to promote corporations (like coal, oil, and fuel producers,) whose core enterprise causes local weather change.

Too Little

The distinction between powering your pc with renewable electrical energy and powering your pc with electrical energy generated from coal is negligible if what you do with that pc is purchase shares in Exxon Mobil (NASD: XOM).

Like an oil firm that has a goal to cut back the emissions from its personal operations to zero, whereas ignoring the emissions when its clients burn the fuels it produces, an funding administration firm that reduces its personal emissions whereas ignoring the emissions of the businesses it invests in is lacking the purpose. TIAA is doing simply that.

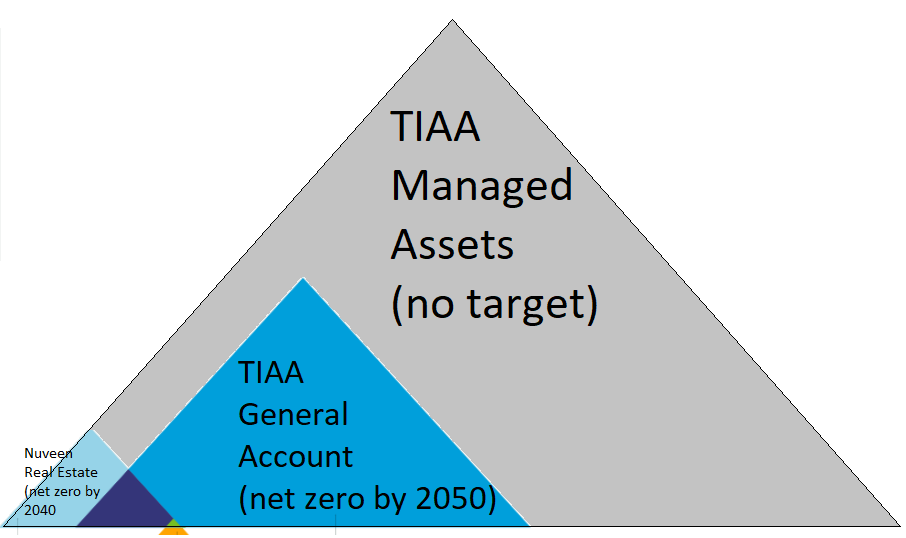

Apparently with out meant irony, TIAA included the next diagram of its emissions targets in its report (slide 17):

The tiny orange/inexperienced triangle represents the carbon emissions from TIAA’s personal operations (i.e the ability that heats and cools its workplaces and powers its computer systems.) The bigger blue triangles signify the financed emissions from the belongings which TIAA owns straight. The (even bigger) financed emissions from the businesses owned by TIAA mutual funds and different funding merchandise will not be even proven. (TIAA has $1.3 trillion below administration. The final account and actual property belongings proven within the diagram are solely a few quarter of that… and nonetheless they make the emissions from TIAA’s personal operations look insignificant.)

In brief, TIAA’s local weather targets solely embody a few quarter of the carbon emissions from the investments it manages… those the place it has essentially the most management. A extra correct image of the related sizes of TIAA’s targets (and lack thereof) can be proven within the expanded diagram under:

Too Late

Even when TIAA’s targets lined all of its belongings below administration, together with solely 2040 and 2050 targets with out vital shorter time period objectives implies that these targets fall far in need of what we have to accomplish to avert the worst results of local weather change.

Based on the Worldwide Panel on Local weather Change, your entire world (and therefore all belongings which TIAA invests in, together with these it manages for others) wants to supply web zero carbon emissions by 2050. To get there, we are able to’t go away a lot of the work till the previous few years. We have to make vital progress by 2030. For TIAA, this would possibly imply shifting up its 2040 web zero targets (Nuveen Actual Property and its personal operations) to 2030, its 2050 goal for the overall account to 2040, and setting extra targets for the funds it manages for others to be one third of the best way to web zero by 2030, two thirds by 2040, and at web zero by 2050.

That’s what it will take for TIAA to cease being a part of the issue.

To be a part of the answer, inexperienced cash administration leaders go a lot additional. A web zero portfolio will be constructed as we speak. We additionally actively spend money on the businesses that may assist the world get to web zero, and keep away from the key greenhouse fuel emitters completely. Not everybody can lead, so I’ll be blissful if TIAA simply stops being a part of the issue. The earlier the higher.

DISCLOSURE: No positions in any corporations talked about.

0 Comments